2017年,全球汽车产量为9730万辆,同比增长2.4%;预计未来五年全球汽车产量将保持在2.0%左右。其中,中国作为全球最大的汽车生产国,2017年产量为2902万辆,同比增长3.2%,全球占比29.8%。

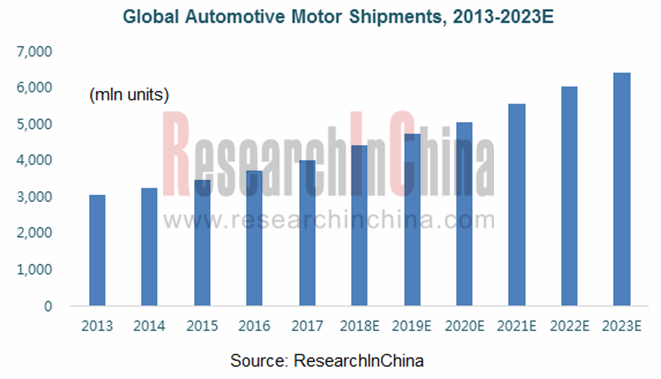

随着汽车产业的发展,汽车技术水平不断提高,电机驱动逐渐取代传统的机械系统。2017年全球汽车电机出货量约39.9亿台,2013-2017年的年均复合增长率为6.9%;在汽车智能化及新能源汽车发展的带动下,预计2018-2023年全球汽车电机的出货量的年均增速在7.5%左右。

汽车电机主要分布在车身、发动机及底盘,其中应用最多的是车身电机,包括电动座椅、电动门窗、电动后视镜等,大多是小型电机。

2017年全球汽车车身电机出货量为24.9亿台,占汽车电机出货总量的62.4%。2017年全球小型电机50%左右的市场份额被Asmo和Mitsuba占据。

目前,全球汽车起动机与发电机90%左右的市场份额被Valeo、Denso、Bosch和Remy占据。其中,Denso是全球最大的汽车起动机与发电机厂家,客户涵盖所有日本厂家和美国通用;Valeo客户主要在欧洲与中国大陆,仅次于Denso。

近年,随着新能源汽车的发展,驱动电机市场快速增长。2017年全球新能源汽车驱动电机市场规模约26.1亿美元,同比增长21.4%;预计2018-2023年市场增速将维持在20.0%以上。

2017年,中国新能源汽车电机市场规模约87.9亿元,其中新能源乘用车电机装机量占比超过60.0%。

在市场竞争格局方面,比亚迪和北汽新能源在新能源电机领域具有一定的市场优势,2017年两家企业的驱动电机的出货量占比均在10%以上。

水清木华研究中心《2018-2023年全球及中国汽车电机(小型电机、起动机与发电机以及新能源汽车用电机)行业研究报告》着重研究了以下内容:

![]() 全球及中国汽车产量、销量等情况;

全球及中国汽车产量、销量等情况;

![]() 汽车电机市场概述、市场规模、市场结构等情况;

汽车电机市场概述、市场规模、市场结构等情况;

![]() 汽车电机细分产品(汽车小型电机、汽车起动机与发电机、新能源汽车用电机)市场规模、竞争格局、市场结构等情况;

汽车电机细分产品(汽车小型电机、汽车起动机与发电机、新能源汽车用电机)市场规模、竞争格局、市场结构等情况;

![]() 国外9家、中国18家汽车电机生产商的经营现状、汽车电机业务等情况。

国外9家、中国18家汽车电机生产商的经营现状、汽车电机业务等情况。

Global automobile output reached 97.30 million units in 2017, a 2.4% rise from a year ago, and is expected to sustain a growth rate of around 2.0% over the next five years. As the world’s biggest producer of automobiles, China made 29.02 million units in 2017, up 3.2% year on year and accounting for 29.8% of the global total.

With the evolution of the automobile industry and automotive technology, electric motor is replacing traditional mechanical system. Global automotive motor shipments approximated 3.99 billion units in 2017, representing a CAGR of 6.9% between 2013 and 2017. As automobile goes intelligent and NEV develops, the world’s automotive motor shipments will maintain an average annual rate of 7.5% or so during 2018-2023.

Automotive motors are mainly distributed in body, engine and chassis. The most used car-body motors, including power seats, power windows/doors and electric rearview mirrors, are largely small motors.

Global car body motor shipments were 2.49 billion units in 2017, occupying 62.4% of total automotive motor shipments. Around 50% share of the world’s small motor market was taken by ASMO and Mitsuba in 2017.

about 90% share of the global automotive starter and generator market is seized by Valeo, Denso, Bosch and Remy. Denso, the world’s largest producer of automotive starters and generators, serves Japanese carmakers and U.S. GM. Second only to Denso, Valeo provides services for customers chiefly in Europe and Mainland China.

As NEV develops, the drive motor market has been growing by leaps and bounds in recent years. Global NEV drive motor market was worth about $2.61 billion in 2017, an upsurge of 21.4% over the previous year, and is predicted to maintain a growth rate of over 20.0% during 2018-2023.

The Chinese NEV motor market was roughly RMB8.79 billion in 2017 with new energy passenger car motor installations seizing more than 60.0%.

BYD and BAIC BJEV have certain advantages, each sharing at least 10% of the country’s total drive motor shipments.

Global and China Automotive Electric Motor (Small Motor/ Starter and Generator/ NEV Motor) Industry Report, 2018-2023 focuses on the followings:

![]() Automobile output and sales in China and worldwide;

Automobile output and sales in China and worldwide;

![]() Automotive motor market (overview, market size/structure, etc.);

Automotive motor market (overview, market size/structure, etc.);

![]() Automotive motor market segments (small motor, starter, generator, and NEV motor)

Automotive motor market segments (small motor, starter, generator, and NEV motor) ![]() (market size, competitive landscape, market structure, etc.);

(market size, competitive landscape, market structure, etc.);

![]() 9 foreign and 18 Chinese automotive motor producers (operation, automotive motor business, etc.)

9 foreign and 18 Chinese automotive motor producers (operation, automotive motor business, etc.)

扫一扫关注微信

扫一扫关注微信